Ocean 11: Top 10 Largest Coins Compared

- Is there such a thing as the best cryptocurrency?

- What about Bitcoin?

- Slow transaction processing

- Attempts to find a solution

- Stablecoins

- Comparing the best 10 cryptos in the world

- Conclusion

To be honest, it should have been Ocean 10, but the title wouldn’t have been cool :). One of the questions that I hear most often, especially from crypto newbies, is “what is the best coin?” Which one to buy? Which one to invest in, and which one is only suitable for trading?

Unfortunately, there are no easy answers here, which is pretty much a theme when it comes to cryptocurrency. That is one of the consequences of the lack of regulations.

However, the crypto industry is still very young. Bitcoin itself, the first and largest cryptocurrency out there, is barely over ten years old. And most of the other coins that make the top 10 are even younger than that.

As a result, choosing the best cryptocurrency can be very difficult, but it can also be an individual decision. Allow me to put these things into perspective.

Content Overview

- What is the best and most stable crypto?

- Is Bitcoin the greatest coin?

- Trying to find solutions

- Top 10 crypto comparison

- Conclusion

What Is the Best and Most Stable Cryptocurrency?

The first thing to note is the value of cryptos, as it can significantly impact your impression of ‘the best coin.’ As you may know, the price of cryptocurrency depends mostly on the investor’s appetite. If a coin becomes a popular payment method, like Bitcoin, many would say that it is the number one coin.

Others tend to believe that the finest one is currently some small cryptocurrency that is developing a game-changing system. If it ends up being successful, its price will grow sharply.

What I’m trying to say is that everyone has their definition of ‘the best coin,‘ which makes the answer somewhat subjective. As far as anyone can tell now, it is certainly Bitcoin. It is the first cryptocurrency and by far the most famous and valuable one.

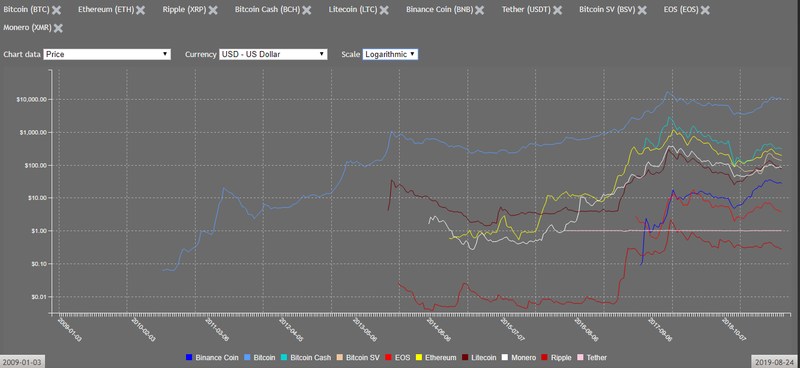

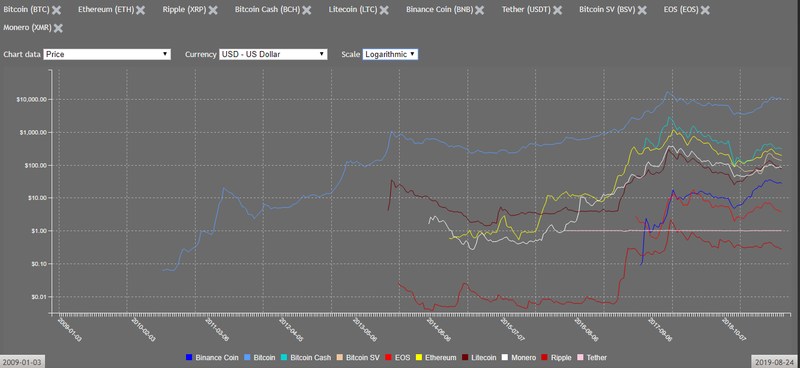

If you take a look at the chart below or click here, you can see the price change of the current top ten largest during the past decade.

Is Bitcoin the Greatest Crypto?

Bitcoin is by far the most searched cryptocurrency on Google Trends, especially in America, Australia, and Europe. A lot of merchants and stores accept it as payment, and you can exchange it for almost any other coin, and vice versa. Furthermore, you can find it on every crypto exchange platform and use it from anywhere and at any time.

It would certainly seem like Bitcoin is the best coin, right? Well, it depends. If you take a look at its underlying technology, things don’t look so bright.

Transaction Processing

Bitcoin’s blockchain can handle less than ten transactions per block, and each block takes 10 minutes, on average, to be processed. This makes it extremely slow. Some of the fastest blockchains can handle thousands of transactions per second.

Even Ethereum is not that fast in comparison with newer coins, and it has one of the busiest blockchains in the industry. In other words, if you make a transaction, you could end up waiting for a long time to have it processed.

Of course, cryptocurrency payments also come with transaction fees, which are then used for releasing new coins. Part of that sum goes to cryptocurrency miners, community members who run the blockchain, as a reward for their work. However, you are the one who chooses the size of the fee.

If you pay more, your transaction is more likely to attract miners, and it will likely be processed quicker. This is good, but it also means that you lose more money in the process. Meanwhile, if you spend less, you will probably wait for hours to have the transaction completed.

From this perspective, Bitcoin certainly doesn’t seem like the best coin anymore.

Not to mention that it is highly volatile, meaning that its price can go up or down by thousands of dollars at any time. What if that happens while you are waiting for miners to process your transaction? Bitcoin’s price could drop or rise significantly after any crypto-related news that may come out. In both cases, you are losing money.

Trying to Find a Solution

Is a more stable coin a better option then? It doesn’t have to be. Developers created different types of currencies to battle several problems. When they realized that Bitcoin is not as anonymous as they believed, they invented privacy coins, which offer better privacy features.

And when they saw there is excellent potential in blockchain, they invented development platforms based on this technology. As for the problem of high volatility, their solution was the introduction of stablecoins.

About Stablecoins

Stablecoins, as the name suggests, are coins with stable prices. Developers can fix their crypto rates using several methods. Some stablecoins backed by fiat currencies, such as the US dollar. Others can be tied to other real-world assets, like gold.

The value never changes, because the developers have enough money to back each coin with one USD. It is an excellent way to resolve the issue of stability. But it also means that the cryptocurrency is no longer fully decentralized.

With stablecoins, the developers have the power, and if they take the USD from the bank and spend it, the coins would end up being completely worthless.

Another method is to back the coin with a certain amount of other cryptocurrencies.

For example, you buy a certain amount of Ethereum and hold it locked away. That amount of ETH is then used for backing another coin, whose price could be whatever you want. For the sake of simplicity, let’s say that it is also $1.

So, with one ETH being worth $210 per coin, purchasing a single Ethereum and locking it away would allow you to release 210 of your own coins into circulation. If Ethereum’s price drops, you would have to add more ETH or retrieve some of your coins from distribution.

This can effectively keep the coin’s price stable and independent from any money or fiat currencies that banks and governments control.

There are also other solutions, each with their flaws and advantages. But in the end, each individual decides which coin is the best.

Cryptocurrencies Compared

It is safe to say that there are no two cryptocurrencies that are the same in the entire crypto space. They could differ in countless different aspects, including:

- Price

- Market cap

- Total supply

- Purpose

- Technology

- Protocol

- Use cases

- Volatility

- Scalability

- Nature and type

This diversity is a good thing, as different coins tend to aim at solving various problems. They also don’t suffer from the same weaknesses, nor do they have the same strength. Even among the top ten largest cryptocurrencies by market cap, there is so much variety.

Of course, the above list doesn’t feature all the categories, but it mentions the main ones. And while it may be challenging to determine which is the number one crypto, at least we identify the best one in each class.

Conveniently enough, most of them sit at the top of the list of the largest cryptocurrencies, which includes:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP (XRP)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Binance Coin (BNB)

- Tether (USDT)

- EOS (EOS)

- Bitcoin SV (BSV)

- Monero (XMR)

Bitcoin

Heading the list is, of course, Bitcoin, the first cryptocurrency ever to be created. This coin caused all the ‘crypto madness’ that followed. It inspired people to seek out decentralization in the financial industry after banking greed caused a financial crisis in the late 2000s.

A mysterious individual or team, known only as Satoshi Nakamoto, created Bitcoin. Nobody knows his true identity, although there are many theories out there.

But what matters is that Nakamoto published Bitcoin’s white paper on October 31st, 2008. That’s when ‘he’ announced to the world that he had come up with a solution for the problem of modern finances.

His solution was a decentralized digital currency called Bitcoin. He launched it on January 3rd, 2009, and the world rejoiced. Well, the world did not care at first. But as Bitcoin’s price started to rise over the years, everyone took notice.

In the years that followed, Bitcoin went through a lot of ups and downs, from controversies to price growths and drops. It has yet to reach its final form, its highest price, and its mass adoption. However, if any coin can do it, it is Bitcoin.

Ethereum

Ethereum is the second-largest cryptocurrency in the crypto market. However, it was not developed as a typical coin that you can use as a means of payment. Instead, it is a development platform-type of project, rather than a cryptocurrency for everyday transactions.

It is the second most crucial cryptocurrency project, as it shifted the attention of developers from coins to the cryptocurrencies’ underlying technology: the blockchain.

Ethereum’s blockchain is already a platform for the creation of smart contracts, which are immutable and self-executable. It is also popular among decentralized application (dApp) creators. The platform is also offering different token models that developers can use for creating their own, new cryptocurrencies.

Ethereum is easily the blockchain that helped create the most altcoins.

Sometimes, coin creators don’t have enough money to develop their blockchain from scratch. That is why they create their coin on Ethereum’s platform.

They then hold a token sale, a.k.a. Initial Coin Offering (ICO), to raise the money, develop their blockchain, and move their tokens to their new home. Ethereum may be slow, with not many transactions going on, but it is undoubtedly the coin that has changed the crypto industry more than any other.

While Bitcoin will always be the number one, Ethereum certainly deserves its second place.

XRP

Then, we have XRP, formerly known as Ripple. XRP is a coin created by a company called Ripple, which uses the crypto to fuel its products, such as xRapid and xCurrent.

Basically, the company’s goal is to revolutionize the methods of sending money cross-border. Technologies that banks have been using so far are extremely slow, often take days to process transactions, not to mention the high money transfer fees.

That’s because banks don’t trust one another, and each transaction must be processed and confirmed by both the sending the receiving banks. Ripple plans is to partner up with all of these institutions so that they use its products.

Ripple would instantly transport money from one bank to the other, with no processing procedure necessary in between.

That would make international transactions near-instant, and Ripple would be the only one offering such services. Therefore, the company and its XRP would become closely tied to the banks worldwide.

Now, Ripple claims that its XRP coin is decentralized and that it would be able to survive even if the company shuts down. Many remain unconvinced of this, however, and the issue has been a topic of many controversies over the years.

Ripple was even sued, while many considered XRP a scam that the company had launched to get money from gullible investors. None of this was ever proven, but skeptics still don’t trust XRP, even though it is the third-largest coin by market cap.

Bitcoin Cash & Litecoin

In the 4th and 5th spots, we have Bitcoin Cash and Litecoin, respectively. Both cryptos are part of Bitcoin’s ever-growing family. However, they are faster than BTC, with bigger block sizes. Litecoin is the quickest of the two, but both are decentralized and accepted on a significant number of exchanges.

From a technical standpoint, both are more advanced than Bitcoin, but neither is as popular. Apart from being faster, Litecoin is also older than BCH, as it launched back in October 2011. In most things, it is almost identical to Bitcoin, except when it comes to block-processing speed.

While Bitcoin can only handle a single block per 10 minutes, Litecoin does the same within 2.5 minutes. In other words, LTC is around four times faster, on average.

BCH

As for Bitcoin Cash (BCH), its creation is a product of controversy. The incident in question came in mid-2017, only a few months before Bitcoin hit its historic ATH (All-Time High) at $20,000. Back then, a group of developers was worried about Bitcoin’s low block size and high fees. They wanted to change Bitcoin’s code by pushing a new update.

However, it was revealed that the update would not increase the block size. Some within the community felt that doing so would be beneficial to those who wanted to invest in BTC, rather than use it as currency for transactions.

That was the cause of a hard fork, a split of Bitcoin’s blockchain that ripped it in two, causing the birth of Bitcoin Cash. From then on, Bitcoin continued in its own path, while BCH followed a separate way.

But the split in the community was no small matter, and it could have easily ended in a disaster. Luckily, it did not happen, and both coins managed to survive until this day.

Binance Coin

Binance Coin (BNB) is intriguing because one of the world’s largest crypto exchanges, Binance, launched it. The exchange enjoys the trust of millions of traders and investors. As such, no one considered its ICO a potential scam, even back in the day when Binance was still young and unknown.

Since its launch, BNB only had one use case: It gave users within Binance’s exchange certain discounts on their transaction fees. However, in 2019, Binance started improving its services to make the coin more and more useful, which resulted in the growth of its price.

The developments allowed BNB holders to buy cryptos on Binance’s Launchpad, a platform for holding token sales. They were also able to do so on Binance’s decentralized exchange, Binance DEX.

Binance also launched its blockchain, where BNB became the native cryptocurrency, as well as other subsidiaries. As a result, people were able to buy cryptos with fiat currencies directly, without having to purchase Bitcoin first and then exchange it for altcoins.

Binance hopes that this would help people get into the crypto space easily. That is why it plans to introduce at least two similar exchanges on each continent. So far, it launched Binance.Jersey and Binance.Singapore, with Binance.US on the horizon as well. To gain further insights into this exchange, make sure to check out the Binance review article.

All of this made BNB very popular and sought after, and its price grew over six times since January 2019 until now.

Tether

Tether is one of the stablecoins I talked about earlier. US dollars back it, and it is pegged to the USD as well, meaning that the value of $1 will always be the same as the value of one USDT.

Tether is the biggest stablecoin in the world, although it is not the only one. It was also a center of a few controversies, with the most notable one being that the company behind it did not provide insight into its bank account.

As a result, no one can confirm or deny that the company has enough money to cover all of its coins.

While you would think that this would make people suspicious, most either don’t know about the controversy, or they don’t care. And the proof is that Tether is still one of the busiest coins on the market.

That’s because it is one of the few coins that you can buy directly with fiat currencies. That gives it great value, even though some of its business practices remain suspicious.

EOS

EOS is a development platform similar to Ethereum. It became its competitor after launching its blockchain a little over a year ago. Many believe it to be the destined ‘Ethereum killer,’ a project that would become superior in every way, and would surpass ETH.

It is certainly much faster and easier to use, with lower fees as well. However, Ethereum still holds the crown of the largest blockchain-based development platform, in addition to the second-largest crypto on the market.

In the future, as EOS’s development continues, it might be possible that it will surpass ETH. However, there is no guarantee that this might happen. Ethereum is a famous brand, and the Securities and Exchange Commission (SEC) announced last year that it was not-a-security.

EOS, on the other hand, launched its blockchain only a year ago, and technical and security issues surrounded the inauguration.

Bitcoin SV

Bitcoin SV might be ninth on the list, but by the time you’re reading this, it could change positions. The crypto’s price is volatile, and could even make it out of the top ten at any time. It never fully stabilized since its creation, and many believe that it never will.

Most people are either for or against the coin due to the circumstances of its creation, which makes it a particularly risky investment.

What are those circumstances, you might ask? Pretty much the same that led to the creation of Bitcoin Cash. However, this time, it was Bitcoin Cash’s blockchain that had forked and not that of the original Bitcoin.

It all happened about a year ago, in November 2018. Two groups of developers once again had different opinions about an update that was scheduled for the BCH blockchain. It caused another hard fork, which resulted in the emergence of Bitcoin SV (BSV).

However, this time, the disaster was not so easily averted, and before BSV got its name, each of the two groups of developers fought the Bitcoin Cash naming rights.

Eventually, the group that wanted to keep BCH the way it was won, while the other coin became BSV, and the Bitcoin family got another member.

Monero

Monero (XMR) is the only privacy coin that makes the top ten. These coins came to life after crypto exchanges were forced to introduce account verifications. As a result, coin holders could no longer protect their anonymity.

However, the developers were having none of it, and they invented coins with sophisticated technologies that make transactions hidden, and extremely difficult (or even impossible) to track.

Monero is one such coin, and it is mostly used by those who wish to stay anonymous. As one of the rare few coins that provide this type of service, it has the backing of a vast community. Its usefulness is the very reason why it ranks in the top 10, even though you can’t find it on most exchanges because of its privacy features.

Still, people found ways to obtain it, and it remains a highly popular coin.

Conclusion

There are many other cryptocurrencies (around 2,440), and all of them have their own story, purpose, technology, goals, and such. The ones I talked about here are only the top ten by market cap, and already you can see how diverse and different they are.

Many find the very concept of cryptocurrencies fascinating because they are dedicated to all of these different causes, and investing in them has become something of an art.

As I mentioned at the beginning of the article, it’s challenging to find the ‘best‘ cryptocurrency. But, at least you’re now familiar with the most popular cryptos in the market, as well as their strengths and weaknesses.

Do you have one of those coins in your digital wallet? Tell us what you think about these cryptos in the comment section below.

very good jon mate. very useful mersii